Usually, banks and the EU are quite involved in account security and ensure that online banking is now very secure and that it is becoming increasingly difficult for scammers and hackers to break into accounts and steal funds. However, when it comes to cash and cryptocurrencies, we are responsible for ensuring the necessary security ourselves, and we need to make sure that we do not become victims of theft, hacks, or scams. So what's the best way to protect our hard-earned cryptocurrency?

Our five safety tips in a nutshell:

- Tell as few people as possible about your crypto investments

- Use hardware wallets to store your cryptos

- Use 2-factor authentication and secure passwords for exchanges

- Avoid using wallets/exchanges in public networks

- Ris diversification: never store everything in one place, in a wallet, or on a single exchange

And here is everything in a bit more detail:

The first and most important thing is to limit who knows that you own cryptocurrencies and how much you store on exchanges or in your wallets. This makes it much more difficult for fraudsters and hackers to specifically target your holdings and accounts. Therefore, you should only tell a select few persons you trust that you own cryptocurrencies at all. If nobody knows about it, it is really hard to fall victim to targeted theft.

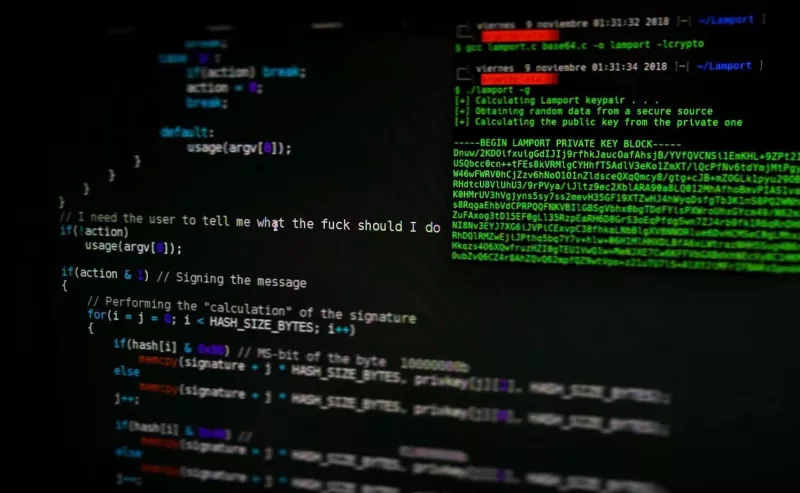

However, this not only covers who we directly tell about our "crypto assets", online or offline but also who we give knowledge of it through our data. A few months ago, for example, it came to light that the popular Chinese app TikTok was spying on the clipboard of iPhone users, copying all data, and sending it to Chinese servers. So, if users copied private keys, crypto addresses, or access data to exchanges with their iPhones, TikTok now also has this data on its servers. But prying eyes can also lurk in public networks trying to steal personal data. If possible, the use of public networks should be avoided. And if it really cannot be avoided, a VPN (What is a VPN?) should be used to encrypt the data sent through the network.

Another thing we need to think about is our strategy for storing cryptocurrencies. Many Hodlers neglect this and just store their coins right where they bought them. But what is the safest way to store cryptocurrencies? The answer to this question is clearly the hardware wallet, which is very popular in the community for a reason. A hardware wallet gives you 100% control over your cryptos without being dependent on a PC or an Exchange. Ever heard the exclamation:

"Not your keys, not your crypto!"?

However, it is still essential that we acknowledge that hardware wallets are not 100% secure either. If you lose your private keys or the wallet itself without a backup or the wallet or the keys fall into the hands of third parties, you can still lose your coins.

Therefore, many Hodlers do not store all their cryptocurrencies in just one wallet or on one crypto exchange but rather distribute them between hardware wallets, software wallets, and exchanges depending on their risk tolerance and needed liquidity. Regardless of whether a hardware wallet dies or is lost, an exchange is hacked, or the hard drive with the software wallet fails, you will never lose everything. Risk Diversification is a significant factor contributing to one's investment security and should always be on every cryptocurrency investor's mind.

Not to forget at exchanges:

When it comes to exchanges, the easiest and likely safest thing to do is to rely on the large and established market players. Binance, Kraken, and other large crypto exchanges are often criticized on Social Media, but they are still the safest options to store cryptocurrencies. Despite the sometimes valid criticism, they have been on the market for years and are therefore much more trustworthy than smaller exchanges that hardly anyone knows and for which proper due diligence is difficult at best.

So much for the basics of security for cryptocurrencies. Did we forget anything important? Make sure to let us know in the comments! Until then, the mantra is:

"Not my Keys, not my Crypto!"

Similar Articles

Massa Labs: A New Blockchain Architecture That Scales Without Sacrificing Decentralization or Security

SUI Network is a new decentralized blockchain platform offering a fast, secure, and scalable network for building decentralized applications with a PoS consensus mechanism and available testnet tasks.

opBNB: Revolutionizing BSC with Scalability and Low-Cost Transactions

Potential Airdrops - be one of the first and you might get great rewards.